Schedule D Tax Form 2025

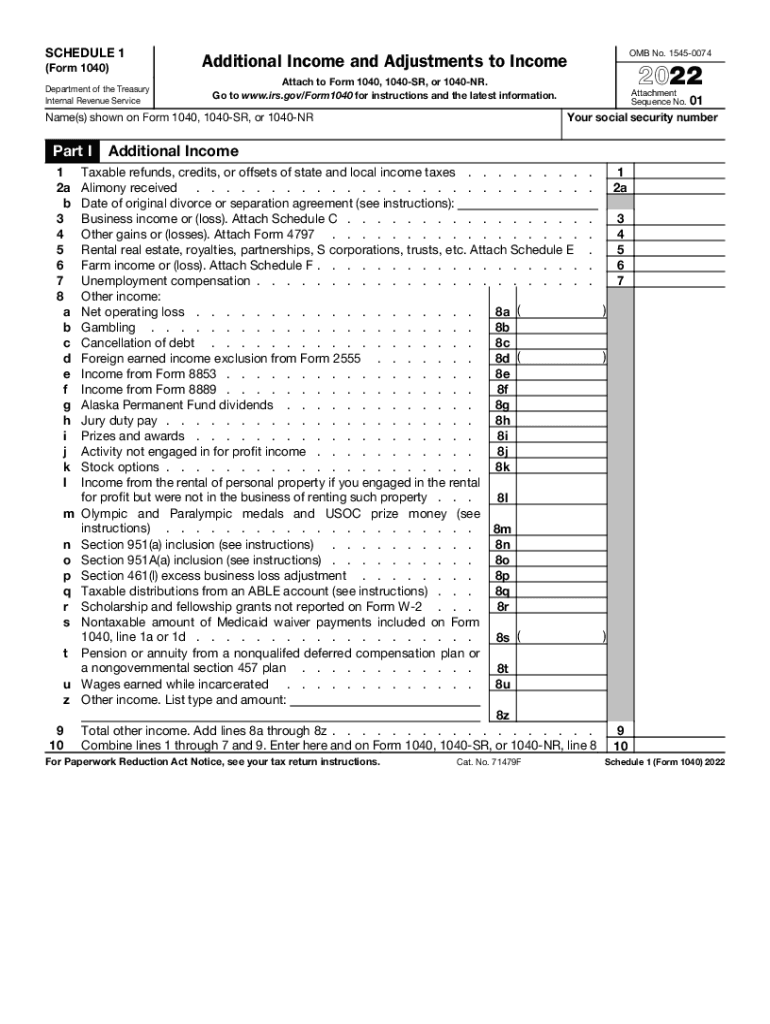

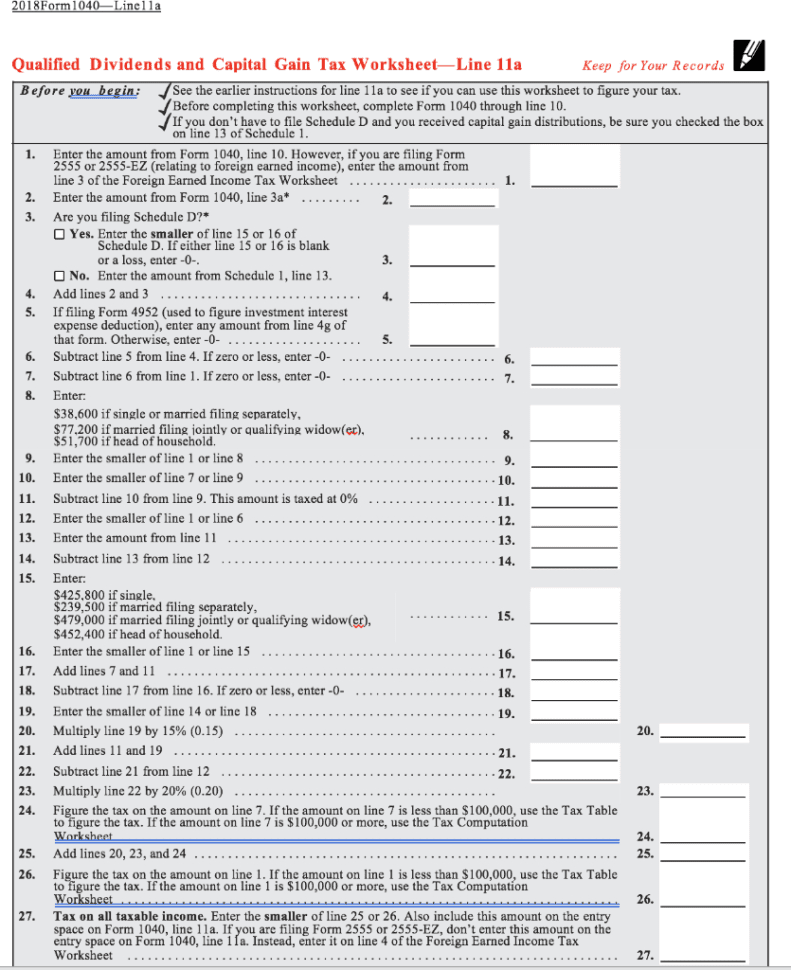

Schedule D Tax Form 2025. Schedule d is a supplementary form attached to form 1040, used by taxpayers to report capital gains and losses from transactions involving capital assets. Use 1 of the following methods to calculate the tax for line 16 of form 1040.

Schedule D Form 2025 2025 Instructions josey marris, Schedule d (form 1040) is a tax schedule from the irs that attaches to the form 1040, u.s.

2025 2025 Forms And Instructions Printable Flossy Marcelia, Learn how to use schedule d during tax season, and who needs it.

2025 Tax Forms 2025 Schedule Genia Jordain, Learn how to report capital gains and losses on tax form 1040 schedule d with the irs.

:max_bytes(150000):strip_icc()/ScheduleD-CapitalGainsandLosses-1-d651471c24974ac79739e2ef580b1c35.png)

Tax Return Forms 2025 Australia Karly Martica, Learn how to report capital gains and losses on tax form 1040 schedule d with the irs.

2025 Instructions For Schedule A 2025 Rorie Rochelle, See lines 1a and 8a , later, for more information about when to use form 8949.

IRS Form 1040 Schedule D Fillable And Editable In PDF 2025 Tax Forms, Use the tax tables in the form 1040 instructions.

Get IRS 941 Schedule B 20172023 US Legal Forms Fill Online, Use 1 of the following methods to calculate the tax for line 16 of form 1040.