Michigan 2025 Tax Rates

Michigan 2025 Tax Rates. The salary tax calculator for michigan income tax calculations. Tax rates can vary based on the individual’s income level and jurisdiction.

Michigan has a flat tax rate of 4.25% for 2025, meaning everyone pays the same state income tax regardless of their. The 2025 gas tax is $0.286.

2025 Tax Brackets Mfj Limits Brook Collete, The michigan tax calculator includes tax. Tax rates can vary based on the individual’s income level and jurisdiction.

How To Lower Michigan Property Taxes Numberimprovement23, 2025 michigan income tax withholding tables: 2025 sales, use and withholding taxes.

2025 Tax Bracket Changes PBO Advisory Group, A michigan state tax return is due april 15, 2025, unless you file for an extension. Michigan pension and retirement payments withholding.

Oct 19 Irs Here Are The New Tax Brackets For 2025 Free Nude, The state’s i ncome tax has decreased from 4.25 percent to 4.05 percent for 2025. Application for extension of time to file michigan tax returns:

Michigan's low tax rate means no problem with new deduction, 2025 sales, use and withholding taxes. Michigan has a flat tax rate of 4.25% for 2025, meaning everyone pays the same state income tax regardless of their.

Arizona State Tax Brackets 2025 Aline Beitris, Michigan's 2025 income tax brackets and tax rates, plus a michigan income tax calculator. The michigan department of treasury announced a return to.

Tax rates for the 2025 year of assessment Just One Lap, The michigan tax calculator includes tax. Michigan's 2025 income tax brackets and tax rates, plus a michigan income tax calculator.

European Fuel Tax Rates 2025 Gasoline and Diesel Excise Duties in EU, 2025 michigan income tax withholding tables: 2025 michigan income tax withholding guide:

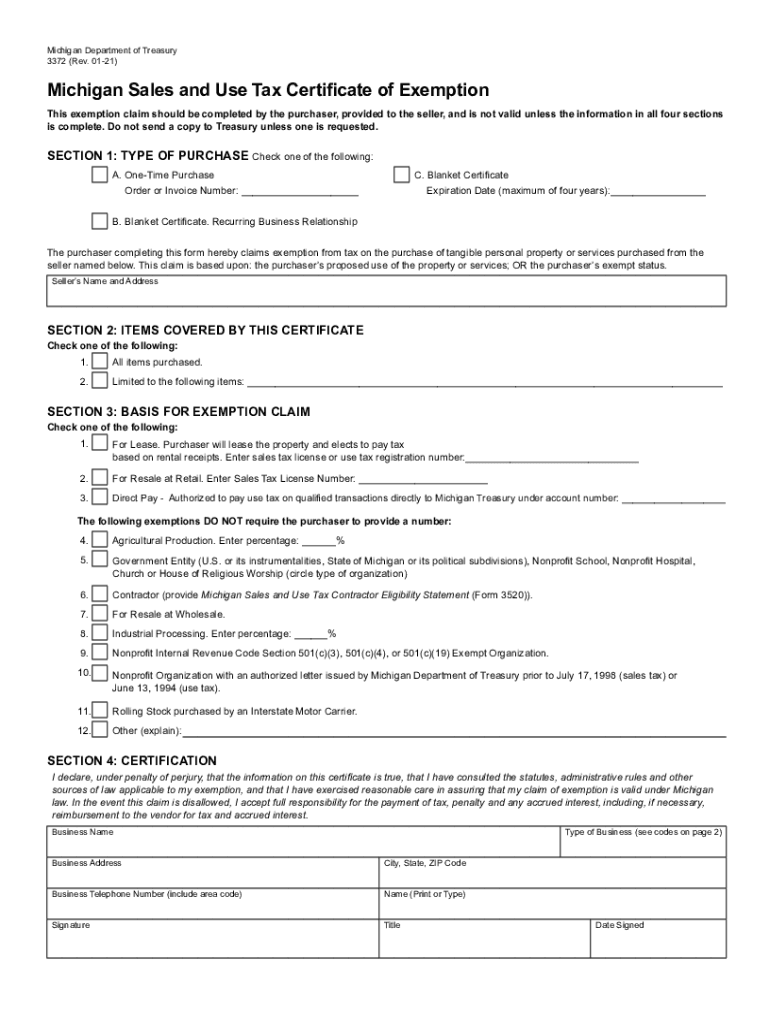

3372 20212024 Form Fill Out and Sign Printable PDF Template, Why did the income tax rate only change for tax year 2025? 2025 sales, use and withholding taxes monthly/quarterly return:

Mi 1040 20192024 Form Fill Out and Sign Printable PDF Template signNow, Individuals and fiduciaries subject to tax under part 1 of the income tax act, mcl 206.1 et seq., are subject to tax at the rate provided under section. The michigan department of treasury feb.